Remitly can only send money from these 17 countries: United Kingdom, the United States, Australia, Canada, Ireland, Germany, France, Italy, Spain, Austria, Belgium, Finland, the Netherlands, Norway, Denmark, Singapore, and Sweden. On the other hand, Remitly offers Express or Economy transfers, and delivery through bank, cash pickup, mobile money, or home delivery. Wise is slightly more transparent and has a simple fee structure for its transfers. Wise Vs Remitly are important to compare because they are both great at international money transfers, but they differ in important ways. These companies are able to keep fees low by utilizing their online efficiencies while still providing cash pickup services through partnerships with local banks and money transfer agents. Thankfully, there is a middle ground, and services such as Remitly offer a solution where the recipient can pick up cash or even have their mobile topped-up. Meanwhile old-school services like Western Union, Ria and Moneygram have traditionally filled this gap which is enabled by large fees and maybe even a horse-drawn cart or two. Wise doesn’t offer cash transfers because it goes against their mission of “ money without borders – instant, convenient, transparent and eventually free.” There are situations where Wise doesn’t work:Ĭash transfers require middle men and that means extra cost which is usually passed on to you.

TRANSFER WISE PLUS

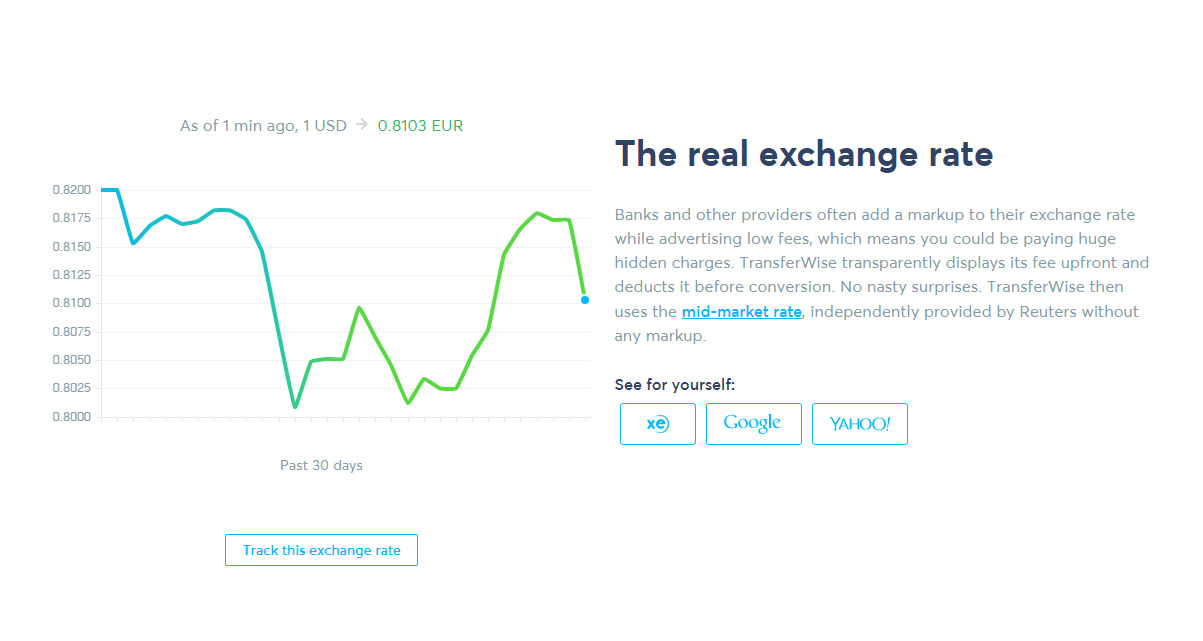

In contrast, banks and the competitors of Wise include a fee in the exchange rate plus they often add on another fee. By using the mid-market rate, Wise ensures that customers avoid bank markups and get the best possible rate for their currency exchange.

This rate is also known as the “real” exchange rate and is the average between the buy and sell rates. The mid-market exchange rate, is the rate used by banks to exchange currencies, to calculate the cost of currency exchange. Instead they use the mid-market rate and then show you the fees upfront. The truth is, that while others claim “no fees” and then build healthy fees into the exchange rate, Wise avoids the usual smoke and mirrors. Using the Wise calculator (no sign up required) you can see the fees and when it will arrive for the amount and currencies you want to transfer.

Wise keeps fees low and transparent, make transfers as fast as possible and they have excellent online customer support.īut don’t take our word for it – try for yourself: Over the years they have proven themselves to be true to their mission: “ money without borders – instant, convenient, transparent and eventually free.” 2.

Wise (formerly TransferWise) transfers are our top pick for money transfers below $7000 USD (£4500 GBP/€4500 EU/$9500 CAD AUD) if you want to send money from one bank to another and are happy doing almost everything online. Total Fees Average – 0.61% (Very Competitive) “Excellent” – 4.4/5 from over 186,000 reviews on TrustPilot (Feb 2023) Regulated in Europe, USA, UK, Australia, Canada, Singapore and Hong Kong

United Kingdom, United States, Australia, Dubai, Hong Kong, Malaysia, Singapore Minimums vary depending on destination but can be as little as the equivalent of $1 USD.Īmericans are $15,000 per day using ACH and $1.6 million per international transfer when funded with a bank wire transfer. > But do not miss What do Wise Customers Say? (including Negative Reviews) ⬇️ 💳 Payment optionsīank account (ACH, SWIFT or wire transfer), debit card, credit card, Apple Pay or Google Pay. Of these, 93% are positive with reviewers indicating Wise is easy to use, has fast transfers and low fees. On Trustpilot, Wise money transfers has a rating of 4.4/5 with over 186,000 reviews, which is considered “Excellent”. What do Wise Customers Say (including Negative Reviews)?

0 kommentar(er)

0 kommentar(er)